This module provides basic information on advantages. The key areas covered are: What is an advantage? What is split receipting? Advantages and split receipting. How does it work? The importance of Fair Market Value to advantages.

Introduction

This module introduces the concept of advantages.

- What is an advantage?

- What is split receipting?

- Advantages and split receipting. How does it work?

- Fair market value and advantages

Advantage

Mr. Smith donates $500 to your Charity. To show your appreciation, your Charity gives him a book. The book is considered an advantage.

An advantage refers to a benefit that the donor receives as a result of his or her donation.

Advantages are essential in determining:

- the intention to give (Intention to Make a Gift threshold)

- the De Minimis threshold

- the eligible amount on the tax receipt

The presence of an advantage triggers the application of the split receipting rule in determining the eligible amount on the official donation receipt.

Split Receipting

Split receipting is a legislative concept in which a donor can receive something in return (an advantage) for a gift, and still be eligible for a tax receipt.

Split receipting rules govern how the eligible amount for a tax receipt is determined. It allows the charity to give a donor certain advantages within the limits allowed by CRA.

Split receipting applies to all types of gifts (cash or gifts-in-kind) with advantages.

From the charity’s perspective, the gift is split into two parts:

- the portion that the charity can issue a receipt for (that is, the eligible amount)

and

- the portion that the charity cannot issue a receipt for (that is, the advantage)

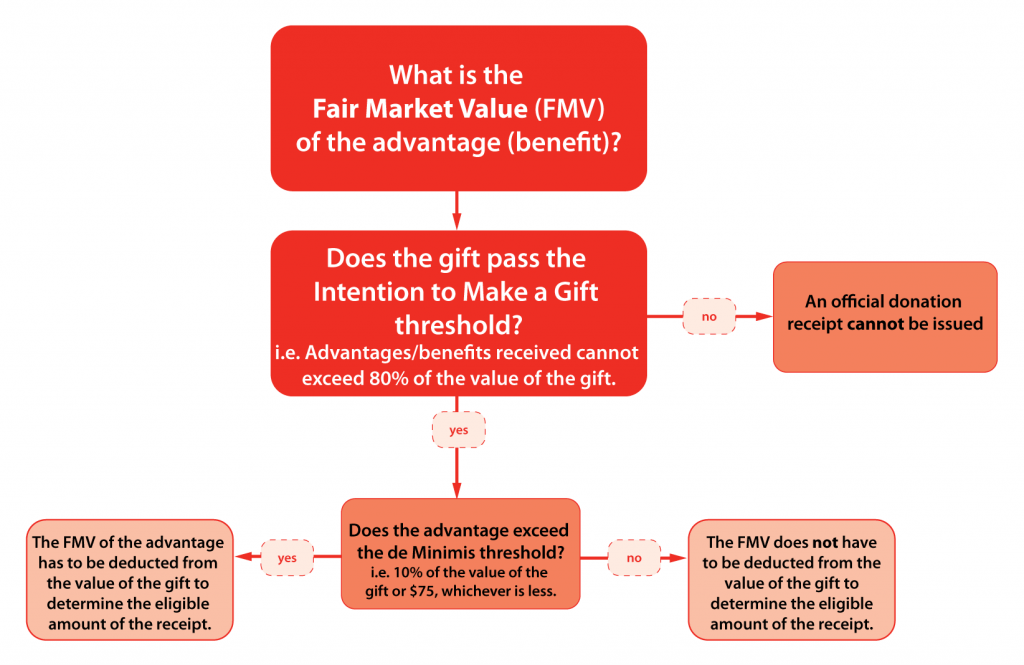

When you apply the rules of split receipting to determine the eligible amount for a receipt of a gift with an advantage, you’ll need to consider three elements:

- fair market value (FMV) of the advantage

more information is available here

- Intention to Make a Gift Threshold

(more information can found at here

- De Minimis threshold

(more information can found here.

These elements are summarized in this chart:

Advantages and Fair Market Value

In simple terms, fair market value (FMV) is the price that you as a consumer would have to pay for the property in an open market.

Importance of FMV and Advantage:

If the FMV of the advantage cannot be determined, an official donation receipt cannot be issued.

For a detailed description on split receipting, go here.

Receipting and Fundraising Events

Specific fundraising examples can be found here.

These examples include:

- fundraising dinners/lunches

- door prizes

- raffles

- auctions

- gift certificates

- golf tournaments

Notice

Information in this module is provided for general educational purposes and not as legal or accounting advice. Consult a lawyer or accountant for professional advice.

Information is accurate as of 2019.

For changes after this date, consult Canada Revenue Agency.