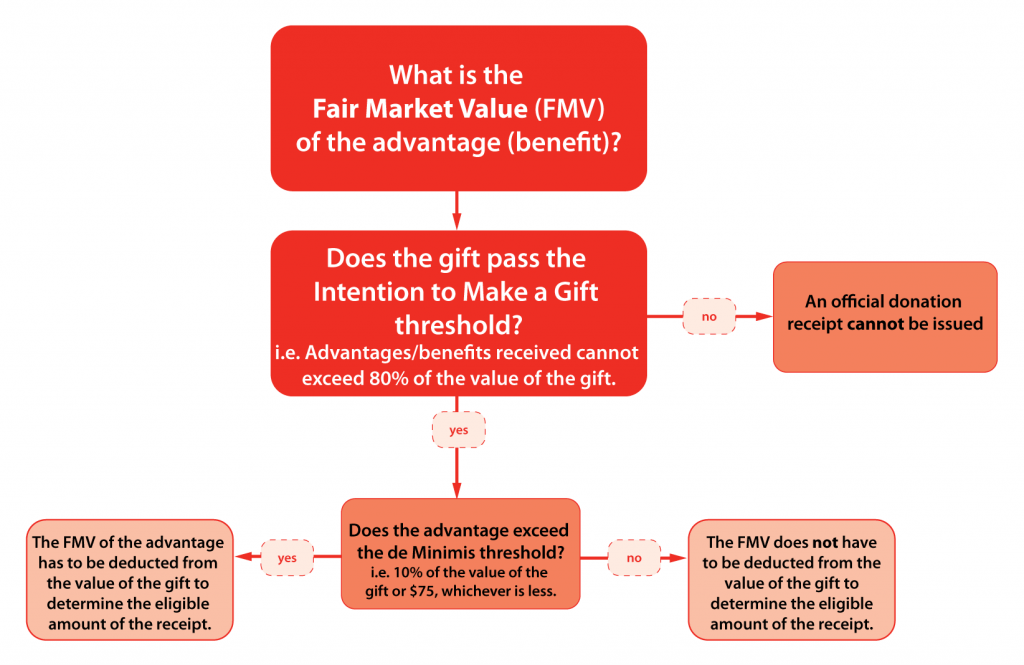

This module covers basic information on the legal concept of split receipting. The information covered includes: What is split receipting and what are the rules? How are the rules applied? What role does Fair Market Value, Intention to Make a Gift, and De Minimus have in split receipting? Are there exceptions to the rule? A chart that illustrates the steps in split

receipting?

Introduction

This module covers basic information on the legal concept of split receipting.

The information covered includes:

- What is split receipting and what are the rules?

- How are the rules applied?

- What role does Fair Market Value, Intention to Make a Gift, and De Minimis have in split receipting?

- Are there exceptions to the rule?

- A chart that illustrates the steps in split receipting?

Split Receipting – The Basics

Split receipting is a legislative concept in which a donor can receive something in return (an advantage) for a gift, and still be eligible for a tax receipt.

From the charity’s perspective, the gift is split into two parts:

- the portion that the charity can issue a receipt (the eligible amount)

and

- the portion for which the charity cannot issue a receipt (the advantage)

The Rules

Split receipting rules govern how the eligible amount for a tax receipt is determined. It allows your Charity to give a donor certain advantages within the limits allowed by CRA.

Split receipting applies to all types of gifts (cash or gifts-in-kind) with advantages.

Applying the Rules

When you apply the rules of split receipting to determine the eligible amount on a receipt for a gift with an advantage, you’ll need to consider three elements:

- Fair Market Value (FMV) of the advantage (benefit received by the donor)

- Intention to Make a Gift Threshold

- De Minimis Threshold

Advantage and Fair Market Value

In simple terms, fair market value (FMV) is the price that you, as a consumer, would have to pay for the property in an open market.

Importance of FMV and Advantage

If the FMV of the advantage cannot be determined, official donation receipts cannot be issued.

Intention to Make a Gift

In the case of a gift with advantages, an official donation receipt can only be issued if the FMV of the advantages is not more than 80% of the FMV of the gift. This is known as the Intention to Make a Gift threshold.

Example

A donor gives $500 to Charity MNO and receives 3 complimentary concert tickets with a fair market value of $150 each for a total value of $450.

- The Intention to Make a Gift threshold, in this case, is $400 (80% of $500).

- The FMV of the advantage is $450 (3 x $150)

- The advantage exceeds the Intention to Make a Gift

- Therefore a receipt cannot be issued.

Note: Even if Charity MNO did not pay for the concert tickets, the FMV still has to be used in determining the Intention to Make a Gift threshold.

De Minimis Threshold

The De Minimis rule allows a donor to receive an official donation receipt for the full amount of their donation, when the advantage is too minimal to affect the value of the gift. The rule states that if the total advantage does not exceed the lesser of $75 or 10 per cent of the amount of the gift, it is not included in the calculation of the eligible amount on the receipt.

Example of De Minimis Threshold

A museum gives small tokens of appreciation to acknowledge donations of certain amounts:

- For a $150 donation, donors receive a calendar worth $14

- For a $200 donation, donors receive a tote bag worth $25

- For a $1,000 donation, donors receive a gift certificate worth $100

Can the museum issue donation receipts for these gifts?

- The $14 calendar is worth less than the lesser of $75 or $15 (10 per cent of the $150 donation) and is therefore not considered an advantage. The advantage is too small (de minimis).

An official receipt can be issued for $150. - The $25 tote bag is worth more than the lesser of $75 or $20 (10 per cent of the $200 donation) and must be considered an advantage.

An official receipt can be issued for $175. - The $100 gift certificate is worth more than the lesser of $75 or $100 (10 per cent of the $1,000 donation) and must be considered an advantage.

An official receipt can be issued for $900.

Exception to De Minimis

The De Minimis rule does not apply to cash or near cash equivalents such as redeemable gift certificates, coupons, vouchers.

This means that any advantages are to be included in the total amount of the advantages, and to be deducted from the value of the gift when determining the eligible amount for the tax receipt.

Steps in Split Receipting

Notice

Information in this module is provided for general educational purposes and not as legal or accounting advice. Consult a lawyer or accountant for professional advice.

Information is accurate as of 2019

For changes after this date, consult Canada Revenue Agency.