This module looks at the basic rules around the Intention to Make a Gift Threshold. The module answers questions on: How is it applied? Why are advantages important? Can you give me an example of applying the Intention to Make a Gift Threshold?

Introduction

This module looks at the basic rules around the Intention to Make a Gift Threshold.

The module answers questions on:

- How is it applied?

- Why are advantages important?

- Can you give me an example of applying the Intention to Make a Gift Threshold?

Intention to Make a Gift – The Basics

The Intention to Make a Gift threshold is applied only when a donor receives advantages (benefits) as a result of the donation.

For a gift with advantages, an official donation receipt can only be issued if the FMV of the advantages is not more than 80% of the fair market value of the gift. This is known as the Intention to Make a Gift threshold.

Definition : Fair Market Value is what a consumer would pay if the gift is bought in the open market.

Example

A donor gives $500 to Charity MNO and receives 2 complimentary concert tickets with a FMV of $150 each. So the total value of the tickets is $300.

Apply the Intention to Make a Gift threshold:

- The Intention to Make a Gift threshold is $400 (80% of $500).

- The FMV of the advantages is $300.

- The advantages do not exceed the threshold.

- Therefore a tax receipt can be issued for $200. ($500 – $300)

Note: Even if Charity MNO did not pay for the concert tickets, the FMV still has to be used in determining the Intention to Make a Gift threshold.

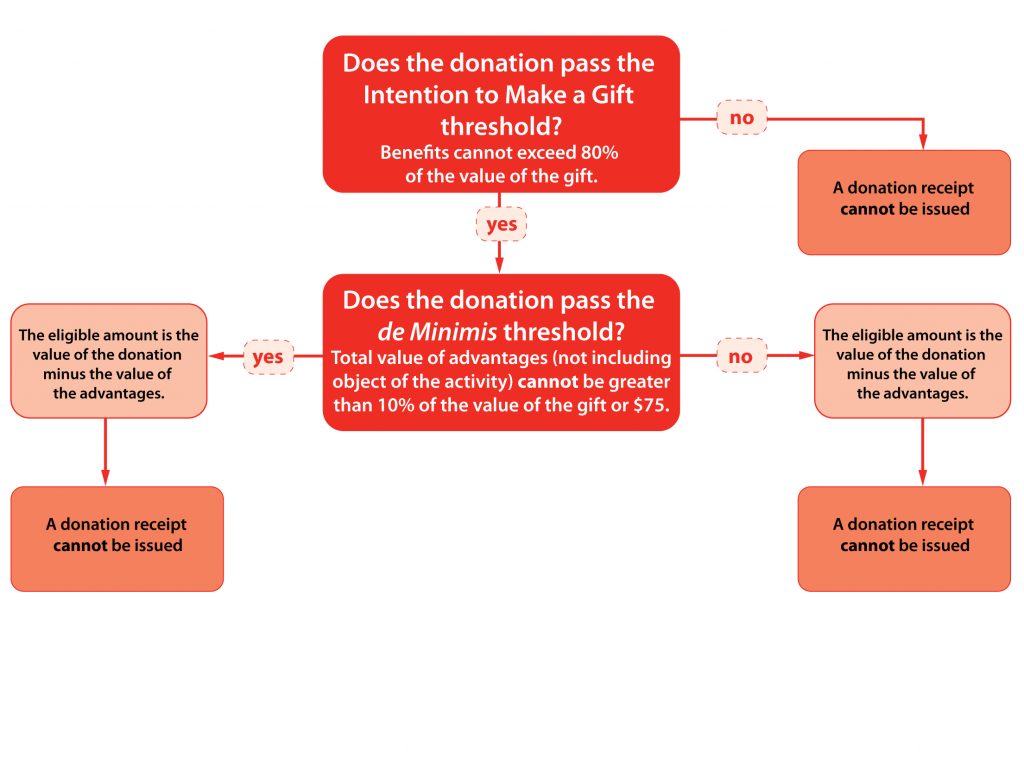

Chart

Notice

Information in this module is provided for general educational purposes and not as legal or accounting advice. Consult a lawyer or accountant for professional advice.

Information is accurate as of 2019.

For changes after this date, consult Canada Revenue Agency.