March 2021

Bill 53: the Service Alberta Statutes (Virtual Meetings) Amendment Act received Royal Assent on March 26, 2021 and is now in force. It updates rules to allow organizations to provide meeting notices, conduct meetings and hold votes using digital technology, if their bylaws do not prohibit it. Learn more.

January 12, 2021

New Insolvency Resource now available.

The Muttart Foundation, in collaboration with the law firm Miller Thomson LLP, has produced a resource to assist groups in coping with financial hardships. Paths Forward in Financially Troubled Times – A Restructuring and Insolvency Guidebook for Charities and Non-profit Organizations. The guidebook lays out a number of avenues that financially-stressed groups can explore. These range from continuing operations in a different legal form or in a collaboration, to revamping finances to survive immediate threats to viability, and to wrapping up the organization and its functions in a prudent and reasonable manner.

CRA Charities and Giving – What’s New (April 21, 2020)

The Charities Directorate call centre has resumed its operations in order to address any questions you may have. The hours of operation are Monday to Friday (except statutory holidays) between 9 am and 5 pm, local time at 1-800-267-2384. The Directorate is working towards a gradual resumption of other services, such as online registrations, while audit activities continue to be suspended until further notice.

Alberta Gaming and Liquor Commission – Information for charities and not-for-profits on charitable use of gaming proceeds during the COVID-19. Click here for more information.

March 27, 2020

- Edmonton Chamber of Voluntary Organizations – Resources and answers for non-profits navigating the pandemic

- Calgary Chamber of Voluntary Organizations – COVID-19 Resources for Nonprofits

- Centre for Public Legal Education Alberta (CPLEA) COVID-19 Information for Albertans on legal matters

Effective February 10, 2020 CRA is introducing a new digital processes to simplify and speed up the way representatives request online authorizations. CRA asks that you please continue to use the existing Representative authorization processes until this time. For more information see: https://www.canada.ca/en/revenue-agency/news/newsroom/tax-tips/tax-tips-2020/changing-how-representatives-authorized.html

CRA will continue to accept complete applications submitted using Form T2050 until September 30, 2019, CRA encourages applicants to apply using the online application form. The online form contains the most up-to-date questions, designed to help CRA process your application more quickly. Check it out here.

To help applicant organizations get started online, CRA has added more information on our My Business Account and Submit your Application webpages. Make sure to consult those pages before applying for registration or re-registration as a charity. If you need help accessing our digital services, or have questions regarding the application process you can contact the Charities Directorate.

Keeping up to date and staying onside in charity law…

Canada Revenue Agency – Charities and Giving

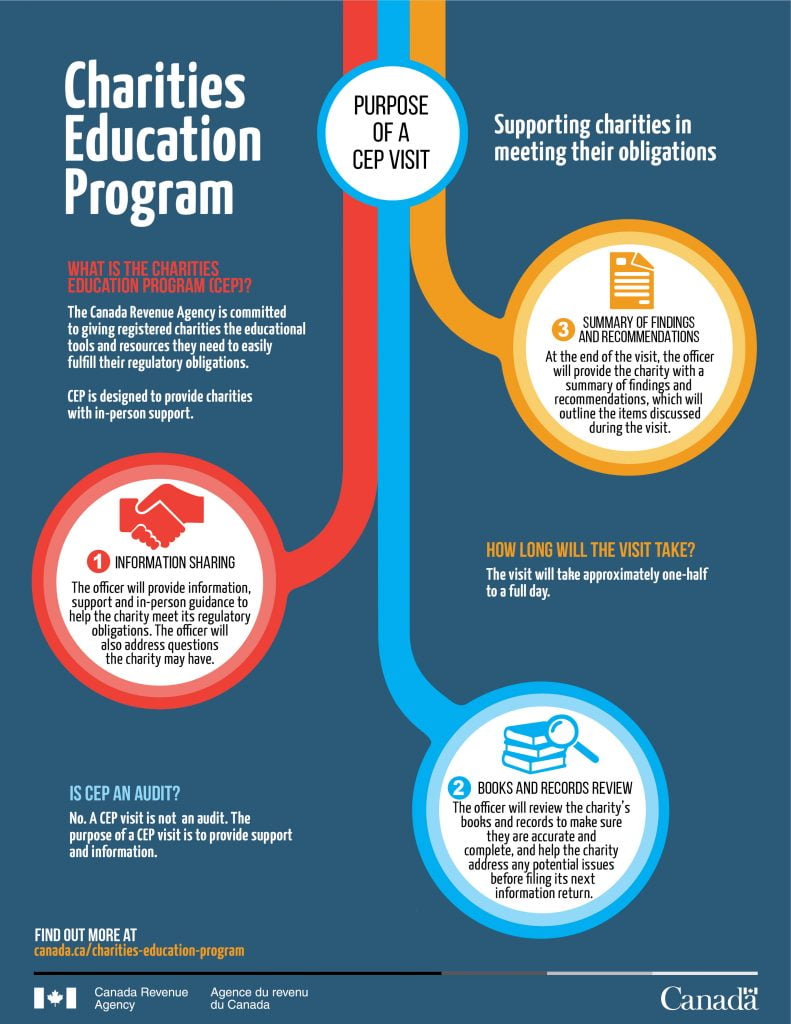

The Charities Education Program (CEP) is designe d to conduct in-person visits with registered charities, providing them with information and assistance in understanding these obligations.

d to conduct in-person visits with registered charities, providing them with information and assistance in understanding these obligations.

Click here for more on the program.

More from CRA for Registered Charities

Use the Charities Directorate website to stay on top of changes: http://www.cra-arc.gc.ca/chrts-gvng/menu-eng.html

- Sign up for the Charities Directorate’s e-newsletter

http://www.cra-arc.gc.ca/chrts-gvng/chrts/cmmnctn/menu-eng.html - Charities Directorate – Electronic mailing list – When you subscribe to this electronic mailing list, CRA will email you when they add important information to the website.

- Self identifying compliance issues – https://www.canada.ca/en/revenue-agency/services/charities-giving/charities/compliance-audits/bringing-charities-back-into-compliance.html

- Checklists for charities – https://www.canada.ca/en/revenue-agency/services/charities-giving/charities/checklists-charities.html

Service Alberta – http://www.servicealberta.com/Charitable_Organizations.cfm

Alberta Corporate Registry – http://www.servicealberta.com/Corporate_Registry.cfm

Alberta NonProfit Network

The Alberta Nonprofit Network (ABNN) is an independent network of nonprofits seeking to advance the cohesive, pro-active, and responsive nonprofit sector in Alberta.

- Sector Source – Charity Tax Tools

- Early Alert – https://imaginecanada.ca/en/early-alert

Newsletters

Carters – Non-Profit and Charity Law – Newsletter and Update Bulletin

Drache Aptowitzer – Charity Law Insights

GlobalPhilanthropy.ca. Globalphilanthropy.ca is maintained by the law firm Blumberg Segal LLP (Blumbergs) based in Toronto, Ontario, Canada. The site provides information designed to assist Canadian charities understand their legal and ethical obligations when operating charities in Canada or abroad.

Organizations offering education and training

These organizations have information on a variety of topics, including requirements and obligations of charitable registration, fundraising practices, receipting, books and records, and more.

These organizations were funded by the Canada Revenue Agency under the Charities Partnership and Outreach Program.

- Centre for Public Legal Education Alberta (Charity Central) (Alberta)

- Éducaloi (Quebec)