Introduction

This module covers basic information on the topic of gifts-in-kind. The following information is provided:

- What is a gift-in-kind?

- What are the specific rules for determining Fair Market Value for some gifts-in-kind?

- What should a receipt for a gift-in-kind look like?

Gifts-in-Kind – The Basics

A gift-in-kind is a voluntary transfer of property other than cash without consideration.

- It includes numerous types of property, in particular, inventory, capital property, and depreciable property.

- Donations of real estate, stocks and bonds or personal items are all considered gifts-in-kind.

- Items of little value, such as hobby crafts or home baking, do not qualify as gifts-in-kind for the purposes of issuing tax receipts.

Gifts-in-Kind – Fair Market Value

There are specific rules about determining the Fair Market Value for some gifts-in-kind such as:

For more information on gifts-in-kind from Canada Revenue Agency, see Interpretation Bulletin IT-297 “Gifts in Kind to Charity and Others” at: www.cra-arc.gc.ca/E/pub/tp/it297r2/README.html

Receipting and Gifts-in-Kind

To issue tax receipts for gifts-in kind, the charity has to determine the fair market value (FMV) of the gift.

The FMV is the price that you, as a consumer, would have to pay for the property in the open market.

In most cases, the value of the gift-in-kind is the fair market value on the date the property (gift) is transferred to the charity.

Discussion on fair market value can be found here.

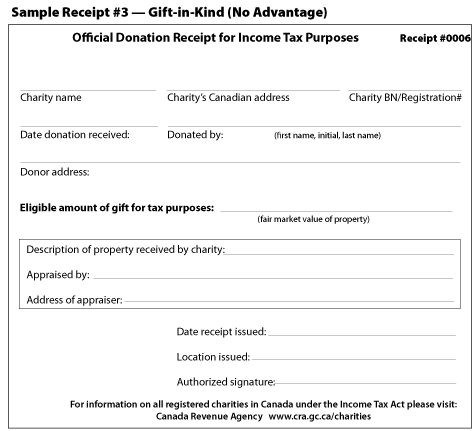

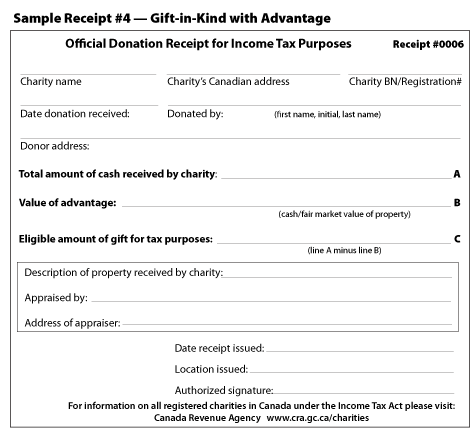

Sample Receipts

This sample receipt is for a gift-in-kind where the donor did not receive any benefits in return.

This is a sample receipt for a gift-in-kind where the donor received benefits as a result of their donation.

Notice

Information in this module is provided for general educational purposes and not as legal or accounting advice. Consult a lawyer or accountant for professional advice.

Information is accurate as of 2019.

For changes after this date, consult Canada Revenue Agency.