This module covers basic information on Fair Market Value (FMV). It answers the questions: What is Fair Market Value (FMV) and why is it important? What are the specific rules for determining FMV? How do I receipt for FMV different types of gifts cash or gifts-in-kind)? What other considerations do I need to take into account when determining FMV? What is Deemed FMV value? GST and Fair Market Value (FMV)

Introduction

This module covers basic information on Fair Market Value (FMV). It answers the questions:

- What is Fair Market Value (FMV) and why is it important?

- What are the specific rules for determining FMV?

- How do I receipt for FMV different types of gifts (cash or gifts-in-kind)?

- What other considerations do I need to take into account when determining FMV?

- What is Deemed FMV value?

Fair Market Value – The Basics

In general terms, fair market value (FMV) is what you, as a consumer, would pay for a property if you were buying it in the open market.

The courts have defined FMV as:

- the highest dollar value you can get for your property

- in an open and unrestricted market,

- on the day that it was transferred,

- between a willing and knowledgeable buyer

- and a willing and knowledgeable seller

- who are acting independently of each other.

Importance of Fair Market Value

- A tax receipt cannot be issued if the FMV cannot be determined.

- It is the Registered Charity’s responsibility to determine the FMV of the gift.

- The FMV is the value of the gift on the day it was transferred to the Registered Charity.

The Specific Rules for Fair Market Value (FMV)

There are specific rules about determining the FMV for some gifts-in-kind such as:

Fair Market Value and Cash Gifts

With cash gifts, the FMV is the amount of cash or the amount on the cheque, money order or other banking instrument.

Fair Market Value and Gifts-in-Kind

General rules for determining the FMV of Gifts-in-Kind

- If the fair market value of the property is expected to be less than $1,000, a member of your Registered Charity, or another individual with sufficient knowledge of the property, may determine its value.

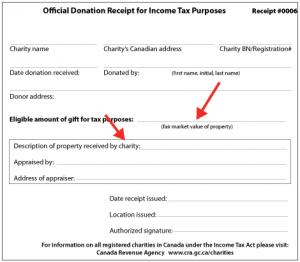

- If the fair market value is expected to be more than $1,000, CRA strongly recommends that the property be appraised by a professional who is not associated with either the donor or the charity. The name and address of the appraiser should be included on the official receipt.

- Certain gifts-in-kind may require using the deemed fair market value rule.

Note: The fair market value of an item does not include taxes paid on purchasing the item.

Sample Receipt

Other Considerations with Fair Market Value

- Replacement value is not the same as FMV.

For example, the replacement value of jewelry stated in an insurance policy is usually higher than the market price if the item were to be sold.

- FMV is always associated with the date the gift (property) was transferred to the charity.

- FMV is the value to be put on the donation receipt. It is not the value that the gifted property may be eventually sold for.

Deemed Fair Market Value

For gifts-in-kind that are not acquired under a tax shelter arrangement, the deemed FMV rules generally apply to tangible personal property such as art, jewelry, antiques.

The deemed FMV of the gift-in-kind is the lesser of:

- the gift’s fair market value

or

- the cost to the donor

or

- in the case of capital property, its adjusted cost base, immediately before the gift was made.

A more detailed description of deemed fair market value is available here.

Notice

Information in this module is provided for general educational purposes and not as legal or accounting advice. Consult a lawyer or accountant for professional advice.

Information is accurate as of 2019.

For changes after this date, consult Canada Revenue Agency.