This module introduces the key concepts in receipting as they relate to general fundraising events. Topics covered include official donation receipts, split receipting, advantages, and fair market value.

Introduction

This module covers:

- What is fundraising?

- When are fundraising activities permissible?

- Introduction to the Guidance on Fundraising By Registered Charities (CG-013) issued by CRA on April 20, 2012

Other modules in this section cover prohibited and questionable fundraising practices, two tests used by CRA to determine if an activity is fundraising, and the ratio of fundraising revenues to expenditures.

Registered Charities and Fundraising

Charities exist to fulfill charitable objects or purposes as stated in their governing documents. A charity cannot exist to raise funds, as fundraising is not a charitable activity.

But for most charities, fundraising is necessary to support their charitable activities.

So fundraising is permissible as long as it complies with the requirements as stated in the CRA Guidance (CG-013).

Details of the guidance are described in the other modules listed on the Fundraising Learning Centre page

What is Fundraising

Fundraising is

- any activity that includes a solicitation of support (statement or representation made to ask for donations)

- by a registered charity or someone acting on its behalf

- to individuals or corporations

- for voluntary cash or in-kind donations

- with or without tax receipts.

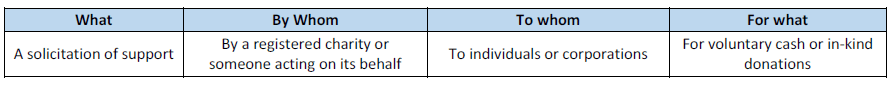

See a summary in the following chart:

Fundraising is:

Solicitation of Support

Solicitation of support is any statement or representation made to ask for donations (cash or in-kind).

It includes:

- the sale of goods or services that is not part of the charity’s regular programs but is sold to raise funds. This applies whether or not donation receipts are issued.

- donor recognition, that is, thanking a donor for making a donation. Costs of the gifts (recognition) given to donors have to be reported as fundraising expenses.

Exception: When the value of the gift is $75 or 10 per cent of the donation, whichever is less, CRA considers this amount to be nominal. So, this nominal cost is to be reported as administrative/management expense.

When a donation receipt is issued as part of an activity, that activity is considered a solicitation of support and the costs associated with the activity are allocated to fundraising.

Whenever a solicitation of support is present in an activity, the charity has to determine if the whole activity or part of the activity is considered fundraising.

- If the whole activity is considered fundraising, the expenses have to be reported as fundraising expenses on the charity’s T3010 form.

- If only part of the activity is considered fundraising, the expenses have to be partly allocated as fundraising expenses and partly as charitable or administrative expenses based on the nature of the activity.

Not Solicitation of Support

Solicitation of support does not include:

- volunteer recruitment

- requests for funding from government or from another charity

These activities are administrative activities and not fundraising activities.

Fundraising Activities

A fundraising activity may be

- a single action, such as a luncheon, or

- a series of related actions, such as a capital campaign to fund a new playground.

There are two general groups of fundraising activities:

- External activities – activities that can be seen by the public, for example, mail campaigns, luncheons, dinners, golf tournaments, fairs, and telethons.

- Internal activities – activities that are relevant to the success of fundraising such as research and planning. Some examples are creating a donor database, a prospective donor list, donor stewardship, donor recognition, and activities relating to organizing fundraising activities.

Who is Responsible

The charity is responsible for both internal and external fundraising activities regardless of who is performing the activities, whether the charity’s staff, volunteers, or third party contractors.

If your charity contracts with a third party to carry out a fundraising activity, you have to show that your charity is in control and directing the fundraising activity.

Information on best fundraising practice indicators is available at Best Practice Indicators

Guidance on Fundraising

The Canada Revenue Agency (CRA) issued a guidance on Fundraising by Registered Charities (CG-013) effective April 20, 2012. The guidance “outlines policies and practices that the CRA uses when it reviews annual information returns filed by registered charities and explains the CRA’s views on issues relevant to fundraising expenditures.”

The guidance is available here.

Contents of the Guidance

The guidance provides direction on:

- distinguishing between fundraising and other expenditures

- allocating expenditures for reporting on Form T3010

- dealing with activities that have more than one purpose

- how the CRA assesses what is acceptable fundraising activity, prohibited and questionable fundraising activities, and what may rule out registration or what may result in a sanction, penalty, or revocation.

Fundraising and Split Receipting

If a donation receipt is issued as a result of a fundraising activity, the expenses incurred on that activity must be reported as fundraising expenditures.

In some cases, donation receipts may need to be issued using split receipting rules.

Information on split receipting can be found here.

Fundraising Events

For some charities, many of their fundraising activities are events. This module does not deal with issuing donation receipts and fundraising events.

Information on fundraising events and receipting can be found here.

Notice

Information in this module is provided for general educational purposes and not as legal or accounting advice. Consult a lawyer or accountant for professional advice.

Information is accurate as of 2019.

For changes after this date, consult Canada Revenue Agency.

Fundraising – The Basics

Introduction (Slide 1)

This module covers:

- What is fundraising?

- When are fundraising activities permissible?

- Introduction to the Guidance on Fundraising By Registered Charities (CG-013) issued by CRA on April 20, 2012

Other modules in this section cover prohibited and questionable fundraising practices, two tests used by CRA to determine if an activity is fundraising, and the ratio of fundraising revenues to expenditures.

Registered Charities and Fundraising (Slide 2)

Charities exist to fulfill charitable objects or purposes as stated in their governing documents. A charity cannot exist to raise funds, as fundraising is not a charitable activity.

But for most charities, fundraising is necessary to support their charitable activities.

So fundraising is permissible as long as it complies with the requirements as stated in the CRA Guidance (CG-013).

Details of the guidance are described in the other modules listed at

https://www.charitycentral.ca/fundraising/fundraising-learning-centre/fundraising-the-basics/

What is Fundraising (Slide 3&4)

Fundraising is

- any activity that includes a solicitation of support (statement or representation made to ask for donations)

- by a registered charity or someone acting on its behalf

- to individuals or corporations

- for voluntary cash or in-kind donations

- with or without tax receipts.

See a summary in the following chart:

Fundraising is:

|

What |

By Whom |

To whom |

For what |

|

Solicitation of support |

By a registered charity or someone acting on its behalf |

To individuals or corporations |

For voluntary cash or in-kind donations |

Solicitation of Support (Slide 5&6)

Solicitation of support is any statement or representation made to ask for donations (cash or in-kind).

It includes:

- the sale of goods or services that is not part of the charity’s regular programs but is sold to raise funds. This applies whether or not donation receipts are issued.

- donor recognition, that is, thanking a donor for making a donation. Costs of the gifts (recognition) given to donors have to be reported as fundraising expenses.

Exception: When the value of the gift is $75 or 10 per cent of the donation, whichever is less, CRA considers this amount to be nominal. So, this nominal cost is to be reported as administrative/management expense.

When a donation receipt is issued as part of an activity, that activity is considered a solicitation of support and the costs associated with the activity are allocated to fundraising.

Whenever a solicitation of support is present in an activity, the charity has to determine if the whole activity or part of the activity is considered fundraising.

- If the whole activity is considered fundraising, the expenses have to be reported as fundraising expenses on the charity’s T3010 form.

- If only part of the activity is considered fundraising, the expenses have to be partly allocated as fundraising expenses and partly as charitable or administrative expenses based on the nature of the activity.

Not Solicitation of Support (Slide 7)

Solicitation of support does not include:

- volunteer recruitment

- requests for funding from government or from another charity

These activities are administrative activities and not fundraising activities.

Fundraising Activities (Slide 8&9)

A fundraising activity may be

- a single action, such as a luncheon, or

- a series of related actions, such as a capital campaign to fund a new playground.

There are two general groups of fundraising activities:

- External activities – activities that can be seen by the public, for example, mail campaigns, luncheons, dinners, golf tournaments, fairs, and telethons.

- Internal activities – activities that are relevant to the success of fundraising such as research and planning. Some examples are creating a donor database, a prospective donor list, donor stewardship, donor recognition, and activities relating to organizing fundraising activities.

Who is Responsible (Slide 10)

The charity is responsible for both internal and external fundraising activities regardless of who is performing the activities, whether the charity’s staff, volunteers, or third party contractors.

If your charity contracts with a third party to carry out a fundraising activity, you have to show that your charity is in control and directing the fundraising activity.

Information on best fundraising practice indicators is available at www.charitycentral.ca/node/495

Guidance on Fundraising (Slide 11&12)

The Canada Revenue Agency (CRA) issued a guidance on Fundraising by Registered Charities (CG-013) effective April 20, 2012. The guidance “outlines policies and practices that the CRA uses when it reviews annual information returns filed by registered charities and explains the CRA’s views on issues relevant to fundraising expenditures.”

The guidance is available at Fundraising Guidance

Contents of the Guidance

The guidance provides direction on:

- distinguishing between fundraising and other expenditures

- allocating expenditures for reporting on Form T3010

- dealing with activities that have more than one purpose

- how the CRA assesses what is acceptable fundraising activity, prohibited and questionable fundraising activities, and what may rule out registration or what may result in a sanction, penalty, or revocation.

Fundraising and Split Receipting (Slide 13)

If a donation receipt is issued as a result of a fundraising activity, the expenses incurred on that activity must be reported as fundraising expenditures.

In some cases, donation receipts may need to be issued using split receipting rules.

Information on split receipting can be found at www.charitycentral.ca/node/56

Fundraising Events (Slide 14)

For some charities, many of their fundraising activities are events. This module does not deal with issuing donation receipts and fundraising events.

Information on fundraising events and receipting can be found at www.charitycentral.ca/node/88

Notice (Slide 15)

Information in this module is provided for general educational purposes and not as legal or accounting advice. Consult a lawyer or accountant for professional advice.

Information is accurate as of April 2012.

For changes after this date, consult Canada Revenue Agency.

_