Is my organization a registered charity?

A “registered charity” is a technical and precise term referring to a charitable organization that is registered under the Income Tax Act (ITA). In order for your organization to be a registered charity, you must have applied for charitable status with the Charities Directorate of the Canada Revenue Agency (CRA).

Municipal, provincial (territorial), federal, and specific commissions and other bodies define the terms “charity” and “charitable” in various ways. Just because your organization is referred to as a “charity” or because you do “charitable” work (that is, helping those in need and not taking any profit) does not necessarily mean that your organization is a registered charity under the ITA.

Your organization can become a registered charity by applying for charitable status with the CRA. Detailed requirements are set out in the rules of the ITA. The process begins by sending in a completed T2050 form. When the process is complete, the federal government provides you with a charities registration number.

Don’t confuse a charities registration number with a fundraising registration number (issued by the province, territory, or municipality) or a corporate number (issued upon registration as a corporation).

My organization is a “non-profit”. Is it a registered charity?

Not necessarily.

A non-profit organization can be set up for any legal purpose as long as its members do not receive a direct financial benefit from the revenues or assets of the organization. A non-profit can operate fully without registering as a registered charity with the Canada Revenue Agency (CRA).

A registered charity, on the other hand, is a technical and precise term that refers to an organization that

- is established exclusively for charitable purposes

- uses its resources (personnel, funds, and property) for charitable activities

- does not operate for profit

- has applied and is registered as a charity under the Income Tax Act (ITA)

- has received a Notice of Registration from the CRA

- has been assigned a charitable registration number by the CRA

More…

For further explanation of the differences between a registered charity and a non-profit organization, go to our Fast Fact on Registered Charity vs Non-Profit.

My organization engages in “charitable” causes in our province. Does that mean that it is a registered charity?

Short Answer

Not necessarily. Just because an organization uses the word “charitable” to describe itself and what it does, the organization is not necessarily a registered charity. An organization can run on a not-for-profit basis without registering as a registered charity with the Canada Revenue Agency (CRA). A “registered charity” is a technical and precise term referring to a charitable organization that is registered under the Income Tax Act (ITA).

Long Answer

Municipal, provincial (territorial), federal, and specific commissions and other bodies define the terms “charity” and “charitable” in various ways. Often, these definitions are not linked to the concept of a registered charity under the ITA.

- In Alberta, an organization that wishes to promote “charitable” purposes can incorporate under either the Companies Act or the Societies Act. Neither of these acts defines the term “charitable” and neither of them links the term to the concept of a registered charity under the ITA. In addition, any organization that wishes to raise funds over $25,000 must register with the provincial government as a “charitable organization” under the Charitable Fund-Raising Act. This applies to both registered charities and non-profits in general. So, if you are a “charitable organization” in Alberta, that does not necessarily mean that you are also a registered charity under the ITA. This lack of a link between the provincial concept of “charity” and ”charitable” and the concept of a registered charity under the ITA can also be found in British Columbia, Manitoba, Ontario, Quebec, New Brunswick, Nova Scotia, and Newfoundland and Labrador.

- In Prince Edward Island, the Charities Act, which defines a “charity” as any organization seeking financial support in order to raise funds for “charitable” purposes, applies to non-profits other than organizations that are registered charities under the ITA.

- In Saskatchewan both the Charitable Fund-Raising Businesses Act andthe Non-Profit Corporations Act refer to “charitable” corporations and “charitable” organizations as corporations and organizations that are registered charities within the meaning of the ITA.

As you can see, most provincial legislation uses the terms “charity” and “charitable” to refer to non-profit work in general and charitable works at an informal level. This does not mean that your organization is a registered charity for the purposes of the ITA and the CRA.

What is a charitable registration number?

Short Answer

A charitable registration number is a number assigned by the Canada Revenue Agency (CRA) to a registered charity.

Long Answer

A charitable registration number has 12 digits and 2 letters. It consists of

- your nine-digit business number (this number is unique and does not change no matter how many or what type of CRA accounts you have)

- the two letters RR identify your account as a registered charity

- 0001 is the reference number used to distinguish between internal divisions with the same program accounts.

Example

987654321RR0001 is an example of a charitable registration number

How can I find out if my organization is a registered charity?

You can

- call the Charities Directorate of the Canada Revenue Agency at 1-800-267-2384 (English) or 1-888-892-5667 (bilingual) and speak to an agent or

search the CRA’s Charity Listing

You may also be able to find this information

- in your organization’s Minute Book (the book that contains your organization’s incorporation documents)

- on your organization’s tax returns

- on your Notice of Registration from the CRA

- from your organization’s lawyer

See also: Understanding Your Corporate Documents

Our charity wants to change to some new activities. Can we do this?

Short answer

Perhaps. First, a charity wishing to start new programs or activities should make sure that the new activities are in step with its objects. Then, it should consult the Charities Directorate of the Canada Revenue Agency (CRA) to check that the new program or activity is charitable and falls within the scope of the charity’s approved purposes (objects).

Long answer

Your charity should send the Charities Directorate a detailed description of the proposed program or activity, as well as any related promotional material (brochures, posters, or newsletters).

In some cases, a charity may have to alter its purpose so that it has a basis for taking on the new activities. If this is the case, after the charity has amended its purposes, it has to send the revised governing documents to the Charities Directorate. Detailed information on the process of changing a charity’s purposes can be found at Changing a Charity’s Purposes.

Can our charity lend its registration number to another organization?

Short answer

No! Under no circumstances should your registration number be loaned to another organization.

Long answer

A charity is responsible for all tax receipts issued under its name and number and must account for the corresponding donations on its annual information return.

Lending the registration number to another organization could lead to the revocation of your charity’s registered status.

I have heard the term “arm’s-length” applied to registered charities. What does it mean?

Short answer

“At arm’s-length” describes a relationship in which the parties act independently of each other.

The opposite —“not at arm’s-length”— includes individuals who are related to each other by blood, marriage, adoption, and common law relationships. Not at arm’s-length also covers people acting together without separate interests, such as those with close business ties.

Long answer

The concept of arm’s-length is used, amongst other things, in registered charities to clarify private benefit. For example, promotional items must be supplied at arm’s-length at a reasonable market value and without any excessive private benefit to the supplier, the charity’s board, or any individual members of the board.

We’ve accomplished our goals! How can our charity wrap up its operations?

Congratulations! You should begin by requesting revocation of your registered status from the Charities Directorate of the Canada Revenue Agency.

Once your charity’s status is revoked,

- you can no longer issue official donation receipts

- you are no longer exempt from income tax

- you must transfer your remaining assets to eligible donees.

More…

If your charity is considering merging, amalgamating, or consolidating with another organization, you should consult with the Charities Directorate at 1-800-267-2384 (English) or 1-888-892-5667 (bilingual) before doing so.

How can I talk to someone at the Charities Directorate of the Canada Revenue Agency?

For inquiries about registered charities, telephone:

- in the Ottawa area 613-954-0410 (English) or 613-954-6215 (bilingual)

- toll free from anywhere else in Canada 1-800-267-2384 (English) or 1-888-892-5667 (bilingual).

How can a registered charity carry out its charitable purpose?

A registered charity can make grants or gifts to other qualified donees or it can carry out its own activities or purposes as set out in its incorporation documents.

Do non-profit organizations and charities have to file income tax returns to Revenue Canada?

Yes. Even though most non-profit organizations are exempt from income tax, the organization must still complete an income tax return each year to report to Revenue Canada. The form that is completed will differ according to whether the organization is a registered charity or whether it is a non-profit that is not also a registered charity.

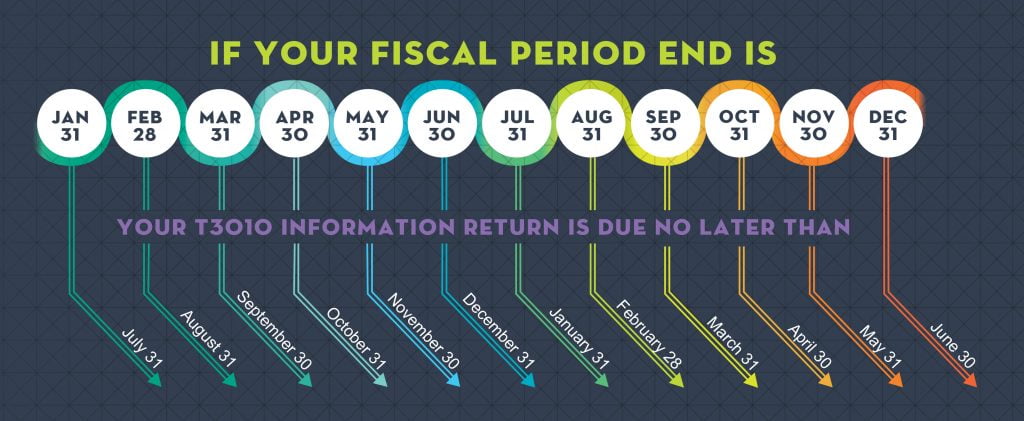

Registered charities must file a Form T3010 and financial statements within six months from the end of each fiscal period. For more information, see the Revenue Canada website at https://www.canada.ca/en/revenue-agency/services/charities-giving/charities.html

Other non-profits must file a T2 Corporation Income Tax Return. Many non-profits that are not registered charities will be able to complete the short version of the T2 annual return form if they have a permanent residence in only one province or territory. If they have a presence in more than one province or territory, the organization will have to complete a regular T2 Corporation Income Tax Return. These forms are available on the Revenue Canada website at https://www.canada.ca/en/revenue-agency/services/forms-publications.html/. This form serves as a federal, provincial, and territorial corporation income tax return, unless the corporation is located in Quebec or Alberta. If the corporation is located in one of these provinces, you have to file a separate provincial corporation return.

Your non-profit organization may have to complete the Form T1044, Non-Profit Organization (NPO) Information Return, if it is not a registered charity and if it meets one of the following conditions:

- the organization received or is entitled to receive taxable dividends, interest, rentals, or royalties totalling more than $10,000 in the fiscal period;

- the total assets of the organization were more than $200,000 at the end of the immediately preceding fiscal period; or

- the organization had to file an NPO return for the previous fiscal period.

Some non-profit organizations are required to pay tax on income from property. This situation will arise when the main purpose of the organization is the provision of dining, recreational or sports facilities for its members. For more information, see the Revenue Canada site at www.cra-arc.gc.ca/E/pub/tp/it83r3/it83r3-e.html

For more information on non-profit organizations and taxes, see the Revenue Canada website at https://www.canada.ca/en/services/taxes/charities.html

Are there residency requirements for the directors of a Canadian charity?

Short Answer:

There is no legal requirement under the Income Tax Act that a Canadian charity have resident Canadian directors.

Long Answer

While there is no legal requirement under tax legislation for Canadian charities to have directors who live in Canada, the Income Tax Act requires that Canadian charities maintain direction and control over their own activities. For groups applying for charitable status or for charities who have obtained charitable status, this may be more difficult to prove where one or more of their directors are not resident in Canada. As well, if the charity is constituted as a corporation, the federal or provincial statute under which it was established or operates may specify certain residency requirements for directors.

More information

Canada Revenue Agency – Registered Charity Newsletter No. 20 (see pg. 3)