This module covers basic information on how to issue proper tax donation receipts for a golf tournament. The module answers questions such as: What advantages should be taken into consideration for a golf tournament? What are the key questions the tournament Fundraising Committee should be asking themselves? Do we need to determine Fair Market Value (FMV), the Intention to Make a Gift Threshold, and De Minimis?

For additional information on this topic from CRA see: Golf Tournaments

Introduction

This module covers basic information on how to issue proper tax donation receipts for a golf tournament.

The module answers questions such as:

- What advantages should be taken into consideration?

- What are the key questions the fundraising committee should be asking themselves?

- Do we need to determine FMV, the Intention to Make a Gift Threshold, and De Minimis?

Receipting and Golf Tournaments

Your Charity is having a fundraising golf tournament. You are responsible for issuing donation receipts.

You know that this requires applying the rules of split receipting because the attendees are receiving advantages.

See the information provided in the learning module on Split Receipting

So you ask to meet with the Fundraising Committee to discuss if an official donation receipt can be issued and for how much.

Advantages and Fair Market Value

Receipting for a golf tournament includes determining the advantages and their fair market values (FMV).

The general advantages may include:

- green fees

- cart rentals

- meals

- complimentary items

- hole-in-one prizes

- door prizes

- attendance of a celebrity at the event

- raffles

The Advantages

Green Fees

For club members, green fees are not included as an advantage. For non-members, green fees are considered an advantage. The FMV of green fees is calculated at the normal rate (group or individual) charged to non-members playing the course at the time of the event.

Cart Rentals

Rental fees of golf carts must be included in the advantages with a FMV at the regular cost.

Meals

Meals are included in the advantages and valued at the group or individual rate that the club would normally charge.

Complimentary Items

If items such as hats or jackets are provided, they are considered advantages. They are valued at the amount that one has to pay to buy the merchandise at an outlet.

Door and Achievement Prizes

These prizes are valued at their FMV. The total of these prizes are pro-rated to all attendees.

Hole-in-One Prizes

These can be excluded. The CRA accepts that for any particular participant, the value of the chance to win the prize is nominal.

Attendance of a Celebrity at the Event

CRA does not consider this as an advantage, unless attendees pay an additional price for the privilege of spending time with the celebrity.

Raffles

This is treated the same way as other fundraising event raffles. Raffle tickets are sold separately. Canada Revenue Agency considers raffles as lotteries and therefore they are not considered advantages.

Example

At your meeting with the fundraising committee, you find out that the committee is planning to sell 100 tickets for the golf tournament.

The elements of the event are:

- Ticket price $2002.

- Green fees$603.

- Cart Rental $ 254.

- Food & drinks $ 405.

- Door prizes -The total FMV of $2,500 or $25 per attendee

- Raffle tickets sold separately

Assuming that the 100 tickets are sold, you will need to explain to the committee how the eligible amount is to be calculated

Questions to Ask Yourself

You can explain how the eligible amount can be calculated by answering these questions:

Are the advantages (prizes and complimentary items) De Minimis? (too minimal to be considered) For more information on De Minimis, go to www.charitycentral.ca/site/?q=node/58

Is there an Intention to Give? (Is the total of the advantages less than 80% of the ticket price?)

More information on Intention to Give is available at www.charitycentral.ca/site/?q=node/57

De Minimus Calculation

Are the advantages (prizes and complimentary items) De Minimis?

The De Minimis threshold is 10% of the ticket price or $75, whichever is less)

Door prizes = $25 per person

De minimis 10% of $200 = $20. $25 exceeds the De Minimis threshold and should be included in the calculation.

Intention to Make a Gift

Is there an Intention to Make a Gift? (Is the total of the advantages less than 80% of the ticket price?)

Total property transferred (ticket price) = $200

Intention to Give threshold is 80% of $200 = $160

Amount of the advantages = $150 (sum of the items listed below)

Green fees$ 60

Cart Rental$ 25

Meal$ 40

Door prizes$ 25

Total Advantage of $150 is less than $160.

So there is an Intention to Make a Gift. An official donation receipt for $50 ($200-$150) can be issued to each participant.

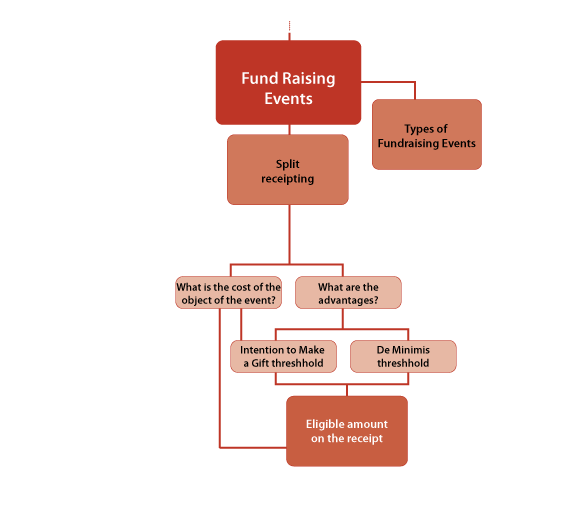

This decision making process is outlined in the following chart

Receipting Process Chart

Notice

Information in this module is provided for general educational purposes and not as legal or accounting advice. Consult a lawyer or accountant for professional advice.

Information is accurate as of 2019.

For changes after this date, consult Canada Revenue Agency.