This module looks at the information that must appear on an official donation tax receipt. This module looks at the information that must appear on an official donation tax receipt.

Introduction

This module looks at the information that must appear on an official donation receipt.

Required Information

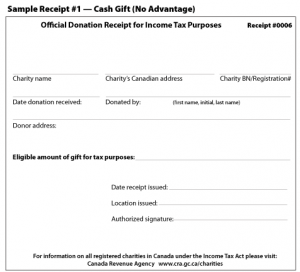

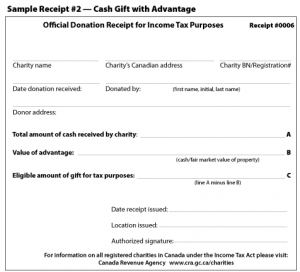

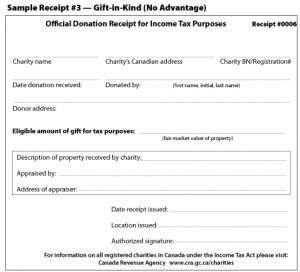

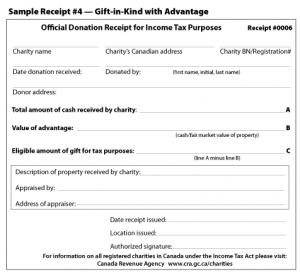

An official donation receipt must include at least the following information, in a manner that cannot be readily altered:

- a statement saying that it is an official receipt for income tax purposes

- the charity’s BN (Business Registration Number)

- name and address in Canada as recorded with the Canada Revenue Agency

- the serial number of the receipt

- the place or locality where the receipt was issued

- if it is a cash donation, the day and year on which the charity received the donation

- the day on which the charity issued the receipt, if that day differs from the date on which the charity received the donation

- the full name (including middle initial) and address of the donor

- the amount of the gift, if the gift was a cash donation.

- the value and description of any advantage received by the donor

- the eligible amount of gift

- the signature of an individual authorized by the charity to acknowledge donations

- the name and website address of the Canada Revenue Agency at www.canada.ca/en/services/taxes/charities.html

Additional Elements

For non-cash gifts (gifts-in-kind), these additional elements are required:

- the day on which the charity received the donation (if it is not already indicated)

- a brief description of the property transferred

- the name and address of the appraiser of the property, if an appraisal was completed

- the fair market value of the property in place of amount of gift above or deemed fair market value if applicable

Sample Receipts

See also more information on tax donation receipts and sample tax donation receipts here.

Please Note: Official donation receipts must include the name and website address of the Canada Revenue Agency. The website address has changed to canada.ca/charities-giving. Charities and qualified donees have until March 31, 2019 to update their receipts.

Notice

Information in this module is provided for general educational purposes and not as legal or accounting advice. Consult a lawyer or accountant for professional advice.

Information is accurate as of 2019.

For changes after this date, consult Canada Revenue Agency.