Registered charities are required to keep records of all offical donation receipts (tax receipts) that they issue. The general issues discussed in this module include: length of time your charity must keep its records, unused tax receipts, electronic receipts and records, and sample tax receipts.

Introduction

Registered Charities are required to keep records of all official donation receipts (tax receipts) that they issue.

We will be discussing general issues including:

- length of time your Charity must keep its records

- unused tax receipts

- electronic receipts and records

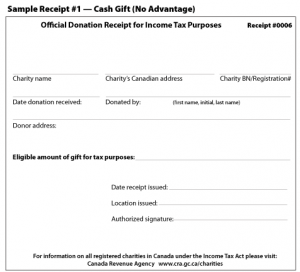

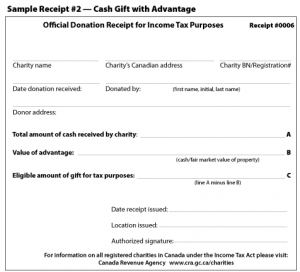

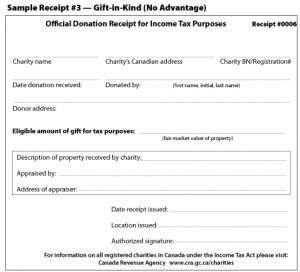

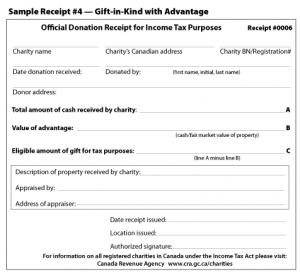

- sample tax receipts

Other information can be found in the Receipting FAQs section here.

Length of Time

Registered Charities are required to keep copies of all official donation receipts for a length of time specified by Canada Revenue Agency.

The length of time to keep the tax receipt is dependent on the type of gifts.

Records must be kept for a minimum of two years from the end of the calendar year in which the donations were made.

and

For a minimum of two years after the date the registration of the charity is revoked.

For information on 10 year gifts see: https://www.canada.ca/en/revenue-agency/services/charities-giving/charities/operating-a-registered-charity/receiving-gifts/10-year-gift.html

Unused Tax Receipts

Blank or unused tax receipts must be kept at the charity’s address as registered with Canada Revenue Agency.

Electronic Tax Receipts

Your Charity can issue official electronic tax receipts as long as they are readable and the data is sufficiently protected from unauthorized access.

Electronic tax receipts can be printed and signed by the authorized person and sent by postal mail to the donor.

Electronic tax receipts can also be signed with an electronic signature and emailed to the donor.

To protect your electronic receipts, you should take these precautions:

- receipts should be in a read only or non-editable format

- receipts should be protected from hackers through the use of appropriate software

- the document should be encrypted and signed with an electronic signature

- the use of a secure electronic signature should be kept under the control of a responsible individual authorized by the charity

- copies of e-mail issued receipts must be retained by the charity

Records of Electronic Tax Receipts

A computer-stored copy of an official donation receipt, known as a “soft copy,” will be considered a duplicate for purposes of the Income Tax Act if the following conditions are met:

- it contains all the necessary information required on official receipts

and

- your Charity can, at any time, print a copy of the receipt without inputting any new data

The computer-stored copy does not have to carry an electronic signature.

More information can be found in Format and Required Information

Sample Receipts

Notice

Information in this module is provided for general educational purposes and not as legal or accounting advice. Consult a lawyer or accountant for professional advice.

Information is accurate as of 2019.

For changes after this date, consult Canada Revenue Agency.