This module provides information on basic receipting practices for cash gifts. The key areas covered are: What is a cash gift? Who is the donor? and sample receipts for cash gifts.

Introduction

This module provides basic information on receipting for cash gifts.

The key areas covered are:

- What is a cash gift?

- Who is the donor?

- Sample receipts for cash gifts

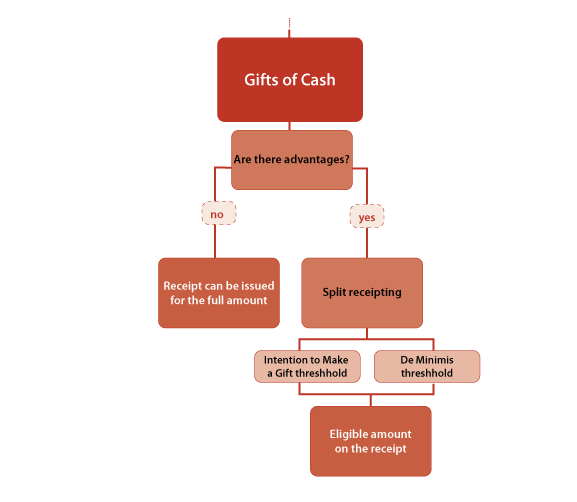

Receipting – Gifts of Cash – Learning Map

Cash Gifts

Canadian tax laws refer to a donation as a gift.

A cash gift is a voluntary transfer of cash to a Registered Charity without consideration (expecting anything in return) by a donor.

Cash gifts may take the form of bills, cheques, credit card slips and/or other banking instruments.

For a more detailed discussion on the elements of a gift, go here.

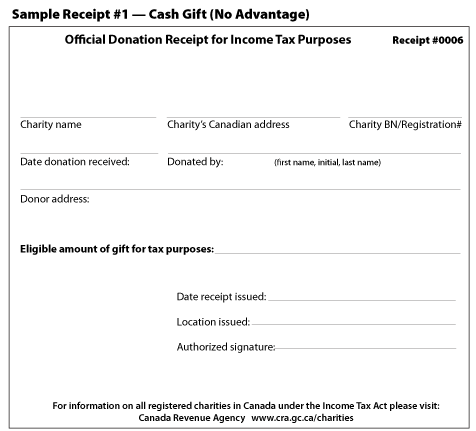

Cash Gifts – No Advantage

To issue a tax receipt for a cash gift, without any advantage, is straightforward.

Receipts can be issued for the amount of cash received in the name of the donor.

Who is the donor?

The donor is generally the name that is on the cheque, credit card or other banking instrument.

If a cheque or credit card is from a joint account, the tax receipt can be issued in either name or both names or as specified by the donor.

If a cheque is written from a corporation account, the tax receipt has to be in the name of the corporation.

If a request is made to have the tax receipt in the name of the signatory, the corporation has to show that the money came from the shareholder’s account.

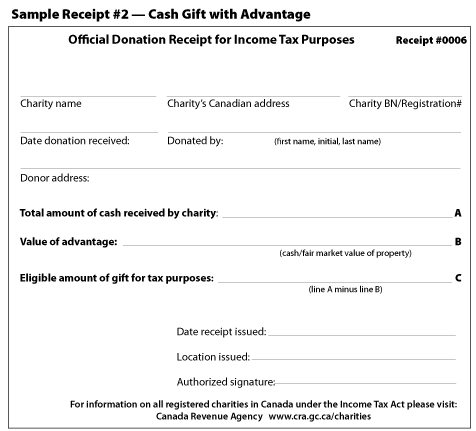

Sample Receipts

Notice

Information in this module is provided for general educational purposes and not as legal or accounting advice. Consult a lawyer or accountant for professional advice.

Information is accurate as of 2019.

For changes after this date, consult Canada Revenue Agency.