Our charity’s fiscal year just ended. How soon do we have to submit our return and what needs to be included?

Short answer

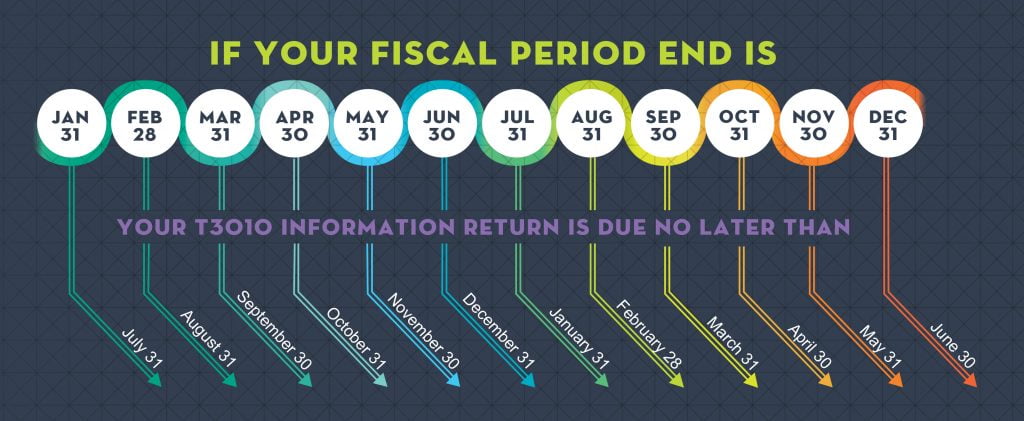

You have six months to file and you must include a Registered Charity Information Return and the Registered Charity Basic Information Sheet (form T3010). Failure to file on time may result in a charity being deregistered.

Example

A T3010 return for a December 31 fiscal period end is due on or before June 30 of the following year.

Long answer

As the Income Tax Act states in s.149.1 (14)

Every registered charity shall, within 6 months from the end of each taxation year of the charity, file with the Minister both an information return and a public information return for the year, each in prescribed form and containing prescribed information, without notice or demand therefor.

More…

The CRA’s instructions for completing the necessary forms can be found at www.canada.ca/content/dam/cra-arc/formspubs/pub/t4033/t4033-16e.pdf

Do we have to get an audit done on the financial statements included with the T3010?

Short answer

Not for the purposes of the Canada Revenue Agency, although your treasurer should sign financial statements that have not been audited. Note, however, that in deciding what charities to audit, CRA uses a risk management approach. One of the factors it may consider in determining whether to investigate a charity is the availability of an independent audit or third party review of the charity’s finances.

Long answer

On the other hand, other government authorities, your charity’s governing body, or its funding bodies may require audited statements.

When setting up and maintaining books and records for our charity, do I have to allow for GST?

Short answer

Yes, in most cases you do have to allow for GST/HST

Long answer

Rules on mandatory registration requirements for charities are stated at https://www.canada.ca/en/revenue-agency/services/forms-publications/publications/rc4082/gst-hst-information-charities.html.

If you are required to register, you may be eligible for rebates.

Registered charities can claim a rebate of 50% of the GST or federal part of HST paid or payable. Charities resident in a participating province that are not selected public service bodies also qualify for a 50% rebate of the provincial part of HST.

Use Form GST66, Application for GST/HST Public Service Bodies’ Rebate and GST Self-government Refund to claim the rebate. If you are eligible to claim a rebate as a charity, claim the amount on line 305 of Part E of the application.

Detailed information on rebates is available at https://www.canada.ca/en/revenue-agency/services/forms-publications/publications/rc4082/gst-hst-information-charities.html

More…

The following Canada Revenue Agency links may be useful in understanding particular GST and HST requirements.

Does a charity have to calculate payroll deductions?

Short answer

If your charity has employees, you have payroll deduction obligations.

More…

For information about payroll deductions, see Canada Revenue Agency’s payroll information.