Introduction

This module introduces the key concepts in receipting as they relate to general fundraising events.

- Official donation receipts

- Split receipting

- Advantages

- Fair market value

Receipting and Fundraising Events

The key concepts in receipting as they relate to general fundraising events are:

- official donation receipts are not required by law

- split receipting

- advantages

- fair market value

Note: “Official donation receipts” and “tax receipts” are used interchangeably in all modules.

Official donation receipts are not required by law.

Registered Charities are not required to issue official donation receipts. Issuing receipts may be a way to encourage donations; however, your Charity can decide when donation receipts will be issued.

In making the decision about issuing receipts, keep in mind:

- The cost of issuing donation receipts in comparison to the net proceeds of the events. For example, if it costs $10 to issue a tax receipt of $10, is it worthwhile to issue such a receipt?

- The total amount of the Charity’s receipting income for the year is the basis for the disbursement quota. So there are times when issuing receipts may create problems with the Charity’s disbursement quota.

Note: It is important to have a policy on receipting and inform the fundraising staff, volunteers and prospective donors.

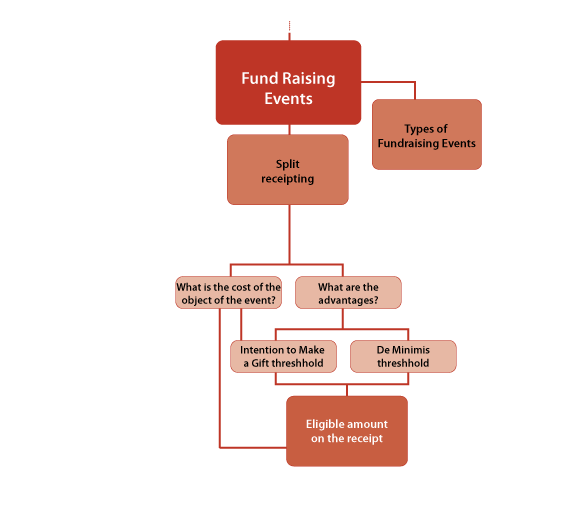

Split Receipting

Split receipting applies to all types of gifts (donations) with advantages, including fundraising events.

Split receipting divides the gift into:

- The portion that cannot be issued on the tax receipt – the advantage

- The portion that can be issued on the tax receipt – the donation

In applying the rules of split receipting to determine the eligible amount on the fundraising event receipt (gift with advantage), you’ll need to consider four elements:

- advantages

- fair market value (FMV)

- Intention to Make a Gift threshold

- De Minimis threshold

Advantages

At fundraising events, participants (donors) pay to participate and usually receive benefits in return. These benefits are known as advantages.

For example, at a fundraising dinner, the main advantage is the meal. There may be other complimentary advantages such as door prizes.

Whenever there are advantages, the rules of split receipting apply.

Fair Market Value

In general terms, fair market value (FMV) is the price that you as a consumer would have to pay for the property in an open market. For example, your Charity is having a fundraising dinner. The meal is an advantage as defined by CRA. The FMV of the meal is the price that a participant would pay if she ordered it herself at a restaurant.

Importance of FMV and Advantage

If the FMV of the advantage cannot be determined, official donation receipts cannot be issued.

Note: There are rules in determining the FMV of different kinds of property. These rules can be found in the Fair Market Value module.

Intention to Make a Gift Threshold

To issue an official donation receipt, a gift cannot have advantages valued at more than 80% of the fair market value (FMV) of the gift.

This is known as the Intention to Make a Gift Threshold.

For example, a donor pays $200 for a ticket to your Charity’s fundraising banquet with door prizes.

- The Intention to Make a Gift threshold, in this case, is $160 (80% of $200).

- FMV of the dinner is $80 and the door prizes work out to be $25 for each participant.

- The total FMV of the advantages is $105 ($80+$25).

- $105 is less than $160, so it passes the Intention To Make a Gift

- Therefore, a tax receipt for $95 ($200- $105) can be issued.

Note: Even if your Charity did not pay for the door prizes, the FMV must still be used in determining the Intention to Make a Gift threshold.

De Minimis Threshold

The De Minimis rule allows a donor to receive an official donation receipt for the full value of the gift if the advantage, not including the object of the event (in the previous example, a meal), is too minimal to affect the value of the gift.

The rule states that if the advantage does not exceed the lesser of $75 or 10 per cent of the amount of the gift, it is not included in the calculation of the eligible amount on the receipt.

Note: The De Minimis rule does not apply to cash or near cash advantages such as redeemable gift certificates, coupons, vouchers.

Example

The price for a banquet ticket is $200. The ticket comes with door prizes, and the FMV of the door prizes, for each person, is $10.

Applying the De Minimis rule of 10% or $75, whichever is less:

-

- 10% of $200 is $20

- The FMV of door prizes is $10

The door prizes are considered minimal as an advantage.

Therefore, they do not need to be included in the calculation of the eligible amount.

Determining the Eligible Amount

Review

The steps in applying split receipting rules to determine the eligible amount on official donation receipts are:

- determine the FMV of the advantages

- apply the Intention to Make a Gift threshold

- apply the De Minimis threshold

- deduct the total value of the advantages (excluding those that are minimal) from the ticket price

Notice

Information in this module is provided for general educational purposes and not as legal or accounting advice. Consult a lawyer or accountant for professional advice.

Information is accurate as of 2019.

For changes after this date, consult Canada Revenue Agency.