This module covers basic information on how to issue proper tax donation receipts for a fundraising dinner. The module answers questions such as: Split receipting and fundraising dinners – what is involved? What do we need to know to issue a proper tax receipt for a dinner event? What steps should be taken to determine Fair Market Value (FMV), the Intention to Make a Gift Threshold, and De Minimus? What would a sample receipt look like for a dinner event?

Introduction

This module covers basic information on how to issue proper tax donation receipts for a fundraising dinner.

The module answers questions such as:

- Split receipting and fundraising dinners – what is involved?

- What do we need to know to issue a proper tax receipt?

- What steps should be taken to determine FMV, the Intention to Make a Gift Threshold, and De Minimus?

- What would a sample receipt look like?

Receipting and Fundraising Dinners

Generally, fundraising dinners involve food, complimentary prizes and other activities. It is considered a fun way to raise money for charities. The participants pay a price higher than the value of the meal and prizes to have fun and to support the charity. It is a win-win situation.

When planning a fundraising dinner, it is very important to determine in the early stages:

- the eligible amount of the official donation receipt for each participant;

and

- for the donors of complimentary prizes – the Fair Market Value (FMV) of the prizes (if any) so that they can be issued official donation receipts.

In many cases, fundraising dinners also include auctions. The issue of receipting for auctions is discussed at www.charitycentral.ca/site/?q=node/89

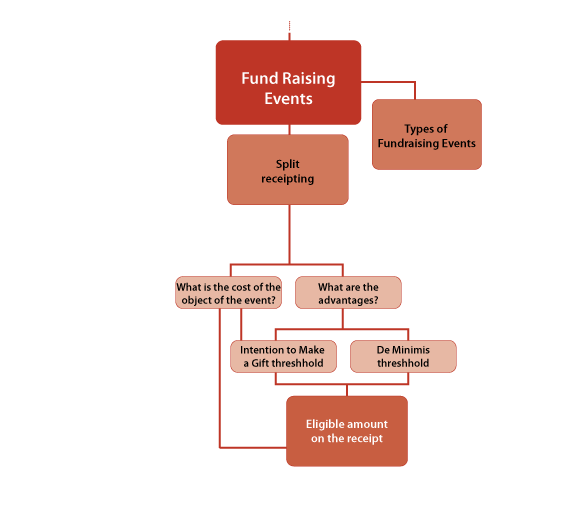

To determine the eligible amount for the receipt, the charity has to apply the rules of split receipting.

See the chart on the following page.

Split Receipting Process Chart

Example

Charity WYZ plans to sell 500 tickets for a fundraising dinner at $130 per ticket. Each ticket comes with a donated book and the dinner. As well, raffle tickets will be sold during the dinner @ $20 each for three prizes with a total value of $2,000.

The fundraising committee wants to know the eligible amount for the official donation receipt, in order to include it in their promotional materials.

The Four Steps

There are four steps in determining the eligible amount for the tax receipt:

- Determine the fair market value (FMV) of the book and the dinner.

Book – it can be purchased from bookstores at $20 each, so the FMV is $20

Dinner – a comparable dinner is priced at $45

- Determine the Intention to Make a Gift threshold

- Will the ticket holder be receiving advantages?

Yes, the dinner and the book.

- Does the advantage exceed 80% of the ticket value?

No. 80% of $130 is $104.

- To summarize:

FMV of the Dinner = $45

FMV of the Book = $20

Total advantages = $65

$65 is less than $104, so it passes the Intention to Make a Gift

Note: Raffle tickets are sold separately and therefore are not included in the calculation.

- Determine if the advantage is De Minimis (minimal)

- The object of the event should not be included in determining De Minimis. In this case, the event is a dinner, so the value of the meal ($45) is not included.

- Is the advantage (benefit) more than either 10% of the value of the donation (i.e. the ticket), or $75?

- Calculation: 10% of $130 is $13, and the advantage of the book is $20

- The advantage (the book) exceeds the De Minimis threshold; therefore it should be included in determining the eligible amount on the official donation receipts.

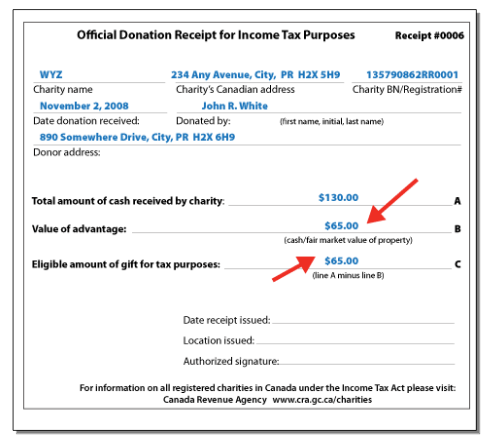

- Determine the eligible amount on the official donation receipt.

Calculation:

| Value of the ticket | $130 |

| Less the value of the dinner | ($ 45) |

| Less the value of the book | ($ 20) |

| Eligible amount | $ 65 |

Each participant can be issued an official donation receipt for $65.

Sample Receipt

Notice

Information in this module is provided for general educational purposes and not as legal or accounting advice. Consult a lawyer or accountant for professional advice.

Information is accurate as of January, 2009.

For changes after this date, consult Canada Revenue Agency.