This module covers the basic information you need to know to issue proper tax donation receipts for your registered charity. The key areas covered are: Who can issue an official donation receipt? What is a qualified donee? What is a gift? What are the elements of a gift? and What is a gift?

Introduction

This module covers the basic information you need to know to issue proper tax donation receipts for your registered charity. The key areas covered are:

- Who can issue tax receipts

- Who are qualified donees?

- What is a gift?

- What are the elements of a gift?

- Kinds of gifts

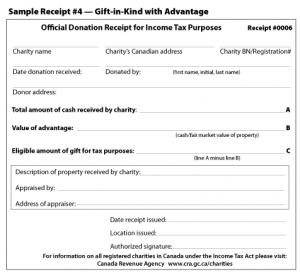

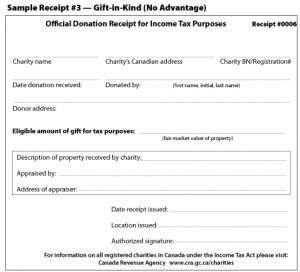

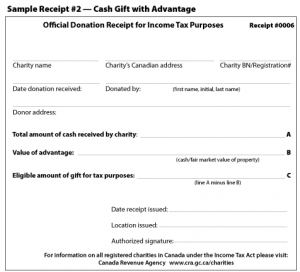

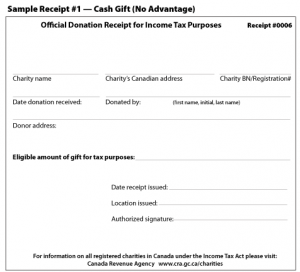

- Sample donation receipts for gifts

Key points to remember

Although Registered Charities may issue other types of receipts, such as business receipts, in these receipting modules we are dealing with official donation receipts (tax receipts) as regulated by Charities Directorate, Canada Revenue Agency. These donation receipts can be used by donors for income tax purposes.

A Registered Charity does not have to issue official donation receipts commonly known as tax receipts. However, most donors assume that tax receipts will be issued. If your Charity has a policy on issuing receipts, it is a good practice to let donors know.

The total donation amount that your Charity has issued receipts for throughout the year is the basis for your Charity’s disbursement quota. For more information on disbursement quota see the Canada Revenue Agency website at https://www.canada.ca/en/revenue-agency/services/charities-giving/charities/operating-a-registered-charity/annual-spending-requirement-disbursement-quota.html

Questions to Consider

Questions to consider when determining whether an official donation receipt can be issued:

- Who can issue official donation receipts? (qualified donees)

- What is a gift?

- What kinds of gifts are there?

- What is the fair market value (FMV) of the gift?

Information on FMV can be found here.

- Has the donor received something in return for the gift (an advantage)?

Who can Issue Tax Receipts? (Qualified Donees)

Only qualified donees can issue official donation receipts for gifts received from individuals and corporations.

Qualified Donees include:

- registered charities

- registered Canadian amateur athletic associations

- registered national arts service organizations

- housing corporations in Canada set up exclusively to provide low-cost housing for the aged

- municipalities in Canada

- under proposed legislation, for gifts made after May 8, 2000, municipal or public bodies performing a function of government in Canada

- the United Nations and its agencies

- universities outside Canada with a student body that ordinarily includes students from Canada

- charitable organizations outside Canada to which the government of Canada has made a gift during the donor’s taxation year, or in the 12 months immediately before that period

-

the government of Canada, a province or territory

What is a Gift?

Canadian tax laws refer to a donation as a gift. Registered charities and qualified donees can issue official tax receipts for gifts received.

A gift is defined as “a voluntary transfer of property without consideration”. There are four elements in this definition:

- Voluntary: given of one’s free will

- Transfer: by a donor to a Registered Charity or qualified donee

- Of property: either in the form of cash or gift-in-kind

- Without consideration: without expecting anything in return

The Elements of a Gift

Let’s consider each element

Voluntary

The donor must not be obliged to give the property (cash or gift-in-kind), for example, as the result of a contract or court order. Donors must give because they want to and not because they have to.

Example

Ms. Hanley gives $200 to the Neighbourhood ISA, a Registered Charity that helps immigrants settle into Canadian society. When asked why, she says that the charity provides a much-needed service to new immigrants, helping them adjust to a new environment.

Transfer

The donor must give the ownership of the property to the Registered Charity unconditionally.

Example

Mr. Reilly gives his car with a fair market value of $3,000 to the ABC Charity. The vehicle registration has to be changed to the name of ABC Charity in order for it to be considered a gift.

An official donation receipt can then be issued for $3,000.

If the fair market value of the car cannot be determined, ABC Charity cannot issue an official donation receipt. A receipt showing that the car was received can be issued, but Mr. Reilly cannot use this receipt when filing his income tax.

Property

The Charity must receive property, either in cash or gifts-in-kind, such as: equipment, stocks, furniture, royalties, real estate, vehicles. Fair market value rules apply to gifts-in-kind in determining the amount for the official donation receipt.

Note: Services are not property and are not considered gifts.

Example

Mrs. Morris gives Charity DEF a crib for their daycare. The crib is property and is considered a gift-in-kind.

After determining its fair market value, Charity DEF can issue a tax receipt for the value of the crib.

Without Consideration

A gift is eligible for a tax receipt if the donor does not expect any benefits other than the usual acknowledgement and a tax receipt.

In general, this principle applies even if the donor receives an advantage or benefit, as long as the transfer of property is made within the Intention to Make a Gift threshold.

If the donor receives an advantage, the rules of split receipting have to be followed in determining the eligible amount of the tax receipt.

Example

Mrs. Martin pays $200 for a GHI Charity banquet ticket. The dinner is the advantage and has a fair market value of $80.

GHI Charity can issue an official donation receipt to Mrs. Martin for $120.

Kinds of Gifts

Gifts for receipting purposes are classified into two general categories:

- Cash gifts

- Gifts-in-kind

Note: Gifts of services do not qualify for tax receipts. This is because services are not considered property and do not fulfill the requirement of a transfer of property.

Cash Gifts

To issue tax receipts for cash gifts without any advantage is straightforward.

Receipts can be issued for the amount of cash received in the name of the donor here.

Gifts in Kind

A gift-in-kind is a gift of property other than cash.

- It includes numerous types of property, in particular, inventory, capital property, and depreciable property.

- Donations of real estate, stocks and bonds or personal items are all considered gifts-in-kind.

Items of little value, such as hobby crafts or home baking, do not qualify as gifts-in-kind for the purposes of issuing tax receipts.

Gifts-in-kind is discussed in detail here.

Sample Receipts

Notice

Information in this module is provided for general educational purposes and not as legal or accounting advice. Consult a lawyer or accountant for professional advice.

Information is accurate as of 2019.

For changes after this date, consult Canada Revenue Agency.